Can Medisave or Insurance Be Used for Cataract Surgery Expenses?

By LSC Clinical Team

Cataract is the most common eye condition in Singapore and surgery is the only method to treat it. Cataract surgery is performed as a day surgery procedure, which means you do not have to stay in the hospital after the surgery. The procedure usually takes 30 minutes to complete.

While it is a day surgery procedure, cataract surgery is Medisave claimable, subject to the approved surgical limit. In addition, if you have an Integrated Shield Plan, you can claim part or all of your cataract surgery cost, depending on your private insurance coverage, for both private and public hospitals.

How much Medisave can be used for cataract surgery?

Medisave is Singapore’s national health savings plan for all Singaporean citizens and Permanent Residents. While you work, a certain percentage of your monthly earnings will be diverted to your Medisave account for future healthcare needs.

With regards to cataract surgery, every Singaporean and Permanent Resident can claim up to $2450 per eye from their Medisave account, or from an immediate family member’s Medisave account. The process of using your medisave is a simple one, with the administrative work done before your surgery.

What’s the procedure to use your Medisave for cataract surgery?

Firstly, the clinic arranging for your surgery will require you to fill up the medical claims authorisation form. Once completed, you need only to pay the balance amount (after deduction of the Medisave claimable amount) via cash or credit card. The rest of the administrative work will be done by the clinic after your surgery, where an e-file will be performed to claim the amount from your Medisave.

Can you use your Integrated Shield Plan (IP) for cataract surgery?

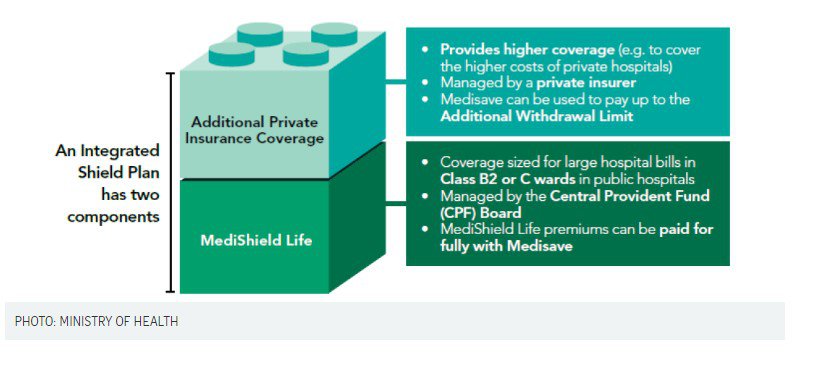

Integrated Shield Plans are private insurance plans that you can choose to add on to your basic MediShield Life plan, which all Singaporeans and PRs have. Depending on your choice of IP, there will be additional coverage for B1 and A class wards in public hospitals and even for private hospitals.

If you have purchased a rider for your Integrated Shield Plan, depending on your rider plan, the claim limit would be higher. For individuals with full riders purchased before 1 April 2019, you will not have to pay anything out of pocket for the surgery*.

*If your full rider is purchased after 8 March 2018 but before 1 April 2019, you will have full coverage on co-insurance and deductible portions of your bill until 1 April 2021. After this date, a 5% co-payment will apply. All full riders sold after 1 April 2019 all have a 5% co-payment minimally.

What’s the procedure to use your Integrated Shield Plan for cataract surgery?

The process to use your Integrated Shield Plan is simple, and can be performed concurrently with the process required to use your medisave for the surgery. Once again, you have to first fill up the medical claims authorisation form. After which, you will need to pay a deposit (the amount of deposit required depends on the type of IP you have) via cash or credit card.

Again, the rest of the administrative work will be done by the clinic after your surgery, where an e-file will be performed to claim the amount from your IP and/or Medisave. If your insurance has full coverage, the deposit paid earlier will then be refunded to you in a few months.

Can I use both Medisave and Integrated Shield Plan concurrently for my surgery?

You can use MediSave, up to prevailing limits, to pay for the deductible and co-insurance portions that are not paid by your insurance policy. The deductible is the initial fixed amount of the medical bill that you need to pay before you can claim anything from your insurance (the deductible is reset each policy year). The deductible ranges from $1,500-3,500, depending on plan and ward class.

After paying your deductible, you may still have to pay for co-insurance. Co-insurance is the amount that you have to split with your insurer after subtracting the deductible from your medical bill. It is usually expressed as a percentage. For example, if you have a co-insurance of 10%, you will pay 10% of the medical bill after the deductible, whereas your insurer pays the remaining 90%.

For individuals with full Integrated Shield Plan Rider purchased, it will cover your co-insurance and deductibles.

Estimate your out-of-pocket expenses after using your medisave and IP:

Fill in the fields according to your policy plan and estimated cataract surgery cost.

For example:

| Cataract surgery cost | $10,000 |

|---|---|

| Deductible (for private hospital) |

$3,500 |

| Co-insurance | 10% (of the balance amount from deducting the deductibles from cataract treatment cost) |

| Total out-of-pocket | $4,150 ($3,500 deductible + $650 co-insurance) |

| Medisave claimable limit for cataract surgery | Up to $2,450 |

| Nett out-of-pocket cost | $1,700 (payable by cash or credit card) |

*Treatment cost used in the example is only for easy illustration, it does not reflect the actual cataract surgery cost.

**This example will not be applicable for individuals with no Integrated Shield Plan.

The remaining cost of the surgery will be covered by your Integrated Shield Plan (IP). As mentioned above, co-insurance and deductibles are fully covered for individuals with full Integrated Shield Plan Rider purchased.

Do all Integrated Shield Plans cover private hospital services?

Yes, all integrated shield plans include coverage for private hospital services. However, the coverage amount depends on the plan you buy. Different insurers will have a slightly different percentage in terms of coverage.

For example, if your integrated shield plan states that it covers “Restructured hospital for ward class B1 and below” then it only covers up to 50%* of the private hospital treatment fees after co-insurance and deductible portions. For integrated shield plan that states “Restructured hospital for ward class A and below”, then it only covers up to 65%* of the private hospital treatment fees after co-insurance and deductible portions. If your integrated shield plan covers “Standard room in private hospital or private medical institution” then it covers up to 100% of the private hospital treatment fees after co-insurance and deductible portions.

*The percentage of coverage is referenced from NTUC IncomeShield website. To fully understand your coverage, please check with your insurer.

If you are intending to go for a cataract surgery but remain uncertain about your Integrated Shield Plan coverage, or if you would like to know the estimated payable amount after the Medisave and Integrated Shield Plan coverage, please contact our friendly Patient Relation Coordinator.

Book an appointment for cataract surgery at LSC Eye Clinic

Tel: +65 6836 1000

Whatsapp: +65 9843 1000

For general enquiries and appointment only

Email: [email protected]

Monday to Friday: 9am to 6pm

Saturday: 9am to 4pm

*Last Registration Time 2pm

Sunday & PH: Closed

sklep internetowy

It’s very interesting! If you need help, look here: hitman agency

zakupy online

It’s very interesting! If you need help, look here: hitman agency

https://69hub.pl

I love your blog.. very nice colors & theme.

Did you design this website yourself or did you hire someone to do it for you?

Plz answer back as I’m looking to design my own blog and would like to know where u got this from.

kudos https://funero.shop

https://miradora.top

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my

blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time

and was hoping maybe you would have some experience

with something like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

I saw similar here: %random_link% and also here: e-commerce

ecommerce

Thanks for the good writeup. It if truth be told used to be a enjoyment account it.

Look complicated to more brought agreeable from you!

However, how can we keep up a correspondence?

I saw similar here: sklep internetowy and also here: sklep internetowy

dobry sklep

I will right away seize your rss as I can not find your e-mail

subscription link or e-newsletter service.

Do you’ve any? Please allow me recognise so that I may just subscribe.

Thanks. I saw similar here: %random_link% and also here:

%random_link%

najlepszy sklep

No matter if some one searches for his vital thing,

therefore he/she wants to be available that in detail, thus that thing is maintained over

here. I saw similar here: %random_link% and also here:

sklep online

sklep online

Hello! I just want to give you a huge thumbs up for your great information you’ve got

right here on this post. I’ll be coming back to your web site for more soon. I

saw similar here: sklep online and also here: sklep internetowy

ecommerce

If you wish for to increase your experience just keep visiting this

web page and be updated with the most up-to-date news posted here.

I saw similar here: sklep online, https://seraphina.top, and

also here: e-commerce

LipoSlend

I came across this wonderful site a couple days back, they produce splendid content for readers. The site owner knows how to provide value to fans. I’m pleased and hope they continue creating excellent material.

dobry sklep

Hello there! This article couldn’t be written any better! Going through this article reminds me of

my previous roommate! He continually kept talking about this.

I will send this information to him. Pretty sure he

will have a very good read. I appreciate you for sharing!

I saw similar here: sklep internetowy and also here: sklep internetowy

zakupy online

It’s very interesting! If you need help, look here: hitman agency

RedAssHottie

However, the successful transformation of learning goes beyond technology alone. It requires a shift in pedagogy, encouraging educators to adopt a facilitative role, guiding students through inquiry-based learning and fostering a growth mindset.

Cynthia Patel

Its such as you learn my thoughts! You seem to grasp a

lot about this, such as you wrote the e book in it or something.

I think that you just can do with a few percent to force the

message house a bit, but other than that, this is magnificent blog.

A fantastic read. I’ll definitely be back.

tadalafil dapoxetine india

mylan tadalafil 5mg cialis otc 2023 low cost tadalafil

tadalafil pulmonale hypertonie

cialis generic name tadalafil cost walmart tadalafil patient education

cialis tablet fiyatı

viagra cialis together cialis 10mg dose tadalafil online purchase

tadalafil culturismo

tadalafil dosing tadalafil female cialis forum cialisde2022

Analytics & social research

It’s very interesting! If you need help, look here: ARA Agency

cialis consumer reviews

cialis dosage information cialis generico desideri tadalafil drug category

viagra advertisement

gas station sildenafil sildenafil viagra dosage viagra purchase online

viagra start dose

viagra supplemennts viagra 100mg pills sildenafil nitric oxide

viagra feminino nome

viagra tablet nz non prescribed viagra viagra for circulation

gia thuoc tadalafil

gia tadalafil 20mg kegunaan cialis tadalafil cialis drug name

tadalafil leber

tadalafil cialis buy aurochem tadalafil reviews cheapest tadalafil uk

viagra price safeway

viagra boots price sildenafil at cvs viagra and vitamins

generika cialis cialiscz2022

cialis otc prг¤parate tadalafil herbal substitute tadalafil bez rp

viagra cena apoteka

brazil military viagra viagra substitute food sildenafil treatment

everyday cialis coupon

cialis tadalafil heallthllines tadalafil citrate chemone tadalafil vardenafil vergleich

viagra wirkung xname

viagra jelly review viagra expiration time viagra site reviews

natural cialis gnc

cialis tadalafil preco tadalafil tabletas plm aurochem tadalafil

viagra pill health

sildenafil 100mg us viagra boys tournée viagra tips

free cialis coupons

cialis generico wikipedia acquisto cialis originale cialis daily reviews

user-379944

awesome